The situation of secondary raw material markets and waste concessions in Hungary – Circular Economy Academy II.

How has the global and domestic secondary raw material markets developed in recent years? What were the main influencing factors? How is the implementation of the waste concession going, and what will MOL’s role be in this? These questions arose on May 2, 2023, at the second online event of the Circular Economy Academy held with more than 30 participants.

As an introduction, Zoltán Toronyi, the managing director of the KEXPORT Cluster operating within the framework of KSZGYSZ, presented the trends in the plastic secondary raw material market in Hungary. During the period between 2022-2023, waste management was characterized by the extremes experienced during the 2008 global crisis, which could be traced mainly in the demand-supply dynamics of secondary raw materials and the volatility of prices. The market for secondary raw materials is largely determined by industrial production, whose waste represents the market supply, and the demand for raw materials generates additional demand. Although one of the main promises of the circular economy is the mitigation of raw material price fluctuations through the provision of secondary raw materials, in practice the availability of these raw materials is quite exposed to extreme market processes. The expert pointed out that the domestic market moves at a different price level than other European countries, and industry bottlenecks (e.g. in the construction industry) can be solved with the arrival of EU funds.

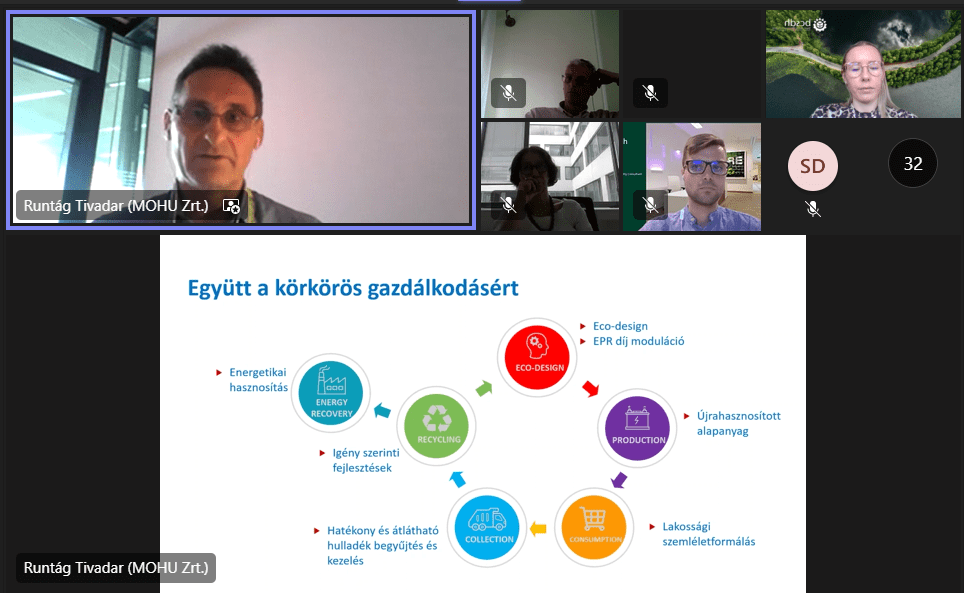

Tivadar Runtág, head of the material flow of MOHU MOL Waste Management Zrt. presented the waste concession coming into force and MOHU MOL’s role in it to the participants. Behind MOL’s role as a concessionaire were interests such as the supply of activities related to the company’s Downstream business (chemical industry, fuel – biogas, energy, rubber bitumen), and the establishment of joint ventures or strategic partnerships with companies that utilize plastic waste, glass, metal and paper. In the field of plastics, their plans include the increase of separately collected plastic packaging waste from 150 to 280 kT: which would be facilitated by activities such as: a redemption system for PET bottles in 5,000+ vending machines; Possibility of separate collection in several households; Standard systems (eg: “All plastic in the yellow bin”); Creation of 83 new waste yards.

The presentations were followed by a panel discussion moderated by Bálint Horváth, CBRE’s senior sustainability consultant. During the conversation, it was discussed how the greater utilization of secondary raw materials can reduce the level of price fluctuations, as well as whether it can trigger the use of primary raw materials. In this matter, the experts highlighted the role of the regulations, which stipulate the mandatory proportion of secondary raw materials in the composition of individual products. Without such measures, relying solely on market mechanisms, in many cases, recycled materials do not replace freshly extracted ones, but only contribute to the increase of material use in the overall economy. Another topic was the creation of marketplaces coordinating the distribution of secondary raw materials, which, based on international experience, greatly help the efficient use of recycled materials, and increase the degree of industrial symbiosis, with which we can create cross-industry material flows. This idea is not yet included in the current plans, but it is worth considering its application once the concession system is established.